How To Report Your Coinbase Taxes in 2025

Key takeaways

- You’re required to report all of your Coinbase crypto transactions on your tax return and pay income or capital gains taxes on them.

- If you have more than $600 of crypto earnings, Coinbase will issue you a 1099, which you can use to file your crypto taxes.

- The easiest way to calculate your Coinbase taxes is to use a crypto tax software like Crypto Tax Calculator, an official Coinbase tax partner.

If you used Coinbase for crypto investing over the past year, it’s important to understand what you need to report on your taxes. Like with other types of investing, tax authorities require you to pay taxes on your crypto transactions. The good news is that with the right tools, reporting your Coinbase taxes can be a relatively seamless process.

In this Coinbase tax guide, you’ll learn:

Coinbase chooses Crypto Tax Calculator as an official tax partner

How is Coinbase taxed?

Many crypto transactions have tax implications, and it’s important to understand these as you prepare to file your income tax return. The type of taxes you’ll pay varies depending on the type of transaction.

Some crypto transactions are subject to capital gains taxes. This is generally the case when you sell or dispose of your cryptocurrency for more than its value when you purchased or received it.

Other types of crypto transactions are taxed as income. This is generally the case when you receive crypto for payment, as a reward, or for other reasons. In this, it’s taxed just like any other income you earn, including that from your job.

Here are the tax implications of some of the most common Coinbase transactions you'll encounter. Note that the specific taxation will vary depending on your local tax laws.

| Transaction type | Tax treatment |

|---|---|

| Selling crypto | Capital gains taxes on the difference between your cost basis and sale price |

| Crypto-to-crypto swaps | Capital gains taxes on the difference between your cost basis and value at the time of the swap |

| Staking crypto | Income taxes on the value of your staking rewards |

| Lending and borrowing crypto | No tax implications for borrowing crypto For lending, income taxes on your interest income |

| Margin trading crypto | Capital gains taxes on the difference between your cost basis and sale price Capital gains taxes on the sale of any crypto as a result of a forced liquidation of your account |

How selling crypto is taxed on Coinbase

When you sell crypto, you’ll pay capital gains taxes on the difference between your cost basis (usually the amount you purchased it for, minus any fees) and the amount you sell it for. If you sell the crypto for less than your cost basis, you have a capital loss and may be able to use it to reduce your tax liability.

How crypto-to-crypto swaps are taxed on Coinbase

Swapping crypto is considered the same as disposing of it. You’ll pay capital gains taxes on the difference between your cost basis and the value of the crypto at the time you swap it. Your cost basis in the new crypto is its value when you receive it.

How staking crypto is taxed on Coinbase

Any rewards you earn from crypto staking are considered and taxed as regular income. You may also pay capital gains taxes on your staking rewards if/when you eventually sell them.

How lending and borrowing is taxed on Coinbase

Borrowing crypto usually doesn’t result in any tax implications. However, you could be on the hook for taxes if you lend crypto and collect interest on it, similar to how you’d pay taxes on any other interest income you earned throughout the year.

How margin trading is taxed on Coinbase

You’ll pay taxes on any gains you earn as a result of margin trading. Forced liquidation of your margin account will also trigger a capital gains tax event.

How to calculate your taxes for Coinbase

When you’re preparing to calculate and report your Coinbase taxes, there are a couple of different approaches you can take. First, you can take a DIY approach. This may be suitable if you only have a few relatively simple crypto tax transactions, such as buying and selling.

To calculate your own Coinbase taxes, you’ll calculate your gains on each transaction by subtracting your cost basis from the price at which you sold the crypto.

That being said, calculating Coinbase taxes can be quite confusing, especially if you have complex transactions. To simplify the process while also getting the most accurate result for your tax return, you can use crypto tax software like Crypto Tax Calculator.

Why the best crypto tax software for Coinbase is Crypto Tax Calculator

If you want to ease some of the stress of reporting your Coinbase taxes, Crypto Tax Calculator may be your best choice.

Crypto Tax Calculator is an official tax partner of Coinbase, which means you can easily link your Coinbase account and calculate your crypto taxes. You can add as many other exchanges, wallets or DeFi platforms as you like to ensure you get an comprehensive and accurate report.

CTC generates tax reports that comply with the requirements of numerous tax authorities, including the IRS, HMRC, ATO, CRA, and many more.

But don’t just take our word for it. Crypto Tax Calculator has a 4.8-star rating on Trustpilot, with countless positive reviews applauding our platform and customer service team.

How to do your Coinbase tax with Crypto Tax Calculator

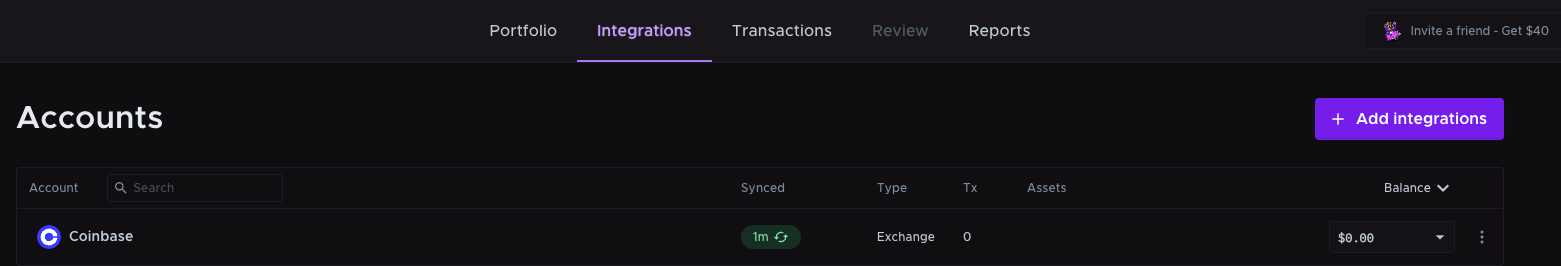

You can choose to import your Coinbase transaction data into Crypto Tax Calculator using one of the three different methods (OAuth, API connection, and CSV upload) based on your preference. By following these steps, you’ll streamline your tax preparation process, ensuring that your Coinbase and other cryptocurrency transactions are accurately reported.

Uploading Your Coinbase Transactions via OAuth

The easiest way to upload your Coinbase transactions is via our 1-click OAuth integration as seen below:

On Crypto Tax Calculator:

-

Log In: Access your account on the Crypto Tax Calculator platform.

Note: If you don’t yet have a Crypto Tax Calculator Account, you can set one up for free using your Coinbase account credentials.

Shortcut: To quickly access the integrations page where you can add Coinbase to your CTC account, follow this link.

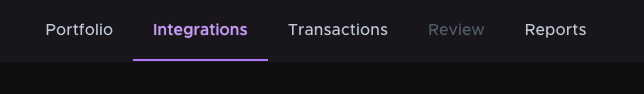

- Go to Integrations tab: Navigate to ‘Integrations’ from the tabs at the top of the page.

-

Add Integration: Click ‘add integrations’ button.

-

Select Coinbase: choose Coinbase as your exchange from the available options.

-

Connect Coinbase: Select the connect coinbase option and then select the ‘Connect to Coinbase’ button.

-

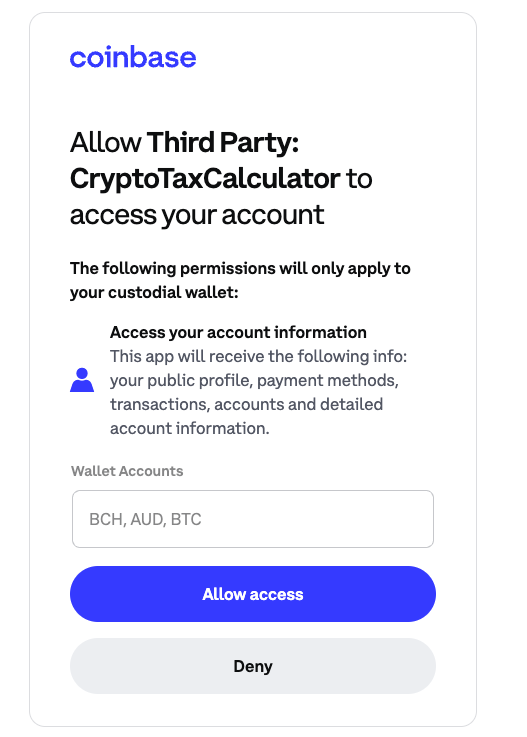

Set permissions: You will be taken to a coinbase page where you can allow access to your wallets.

- After selecting accept, Coinbase should now be attached to your CTC account.

Uploading Your Coinbase Transactions with an API

Using an API connection is a seamless way to import your Coinbase data. Here’s how to set it up:

On Coinbase:

-

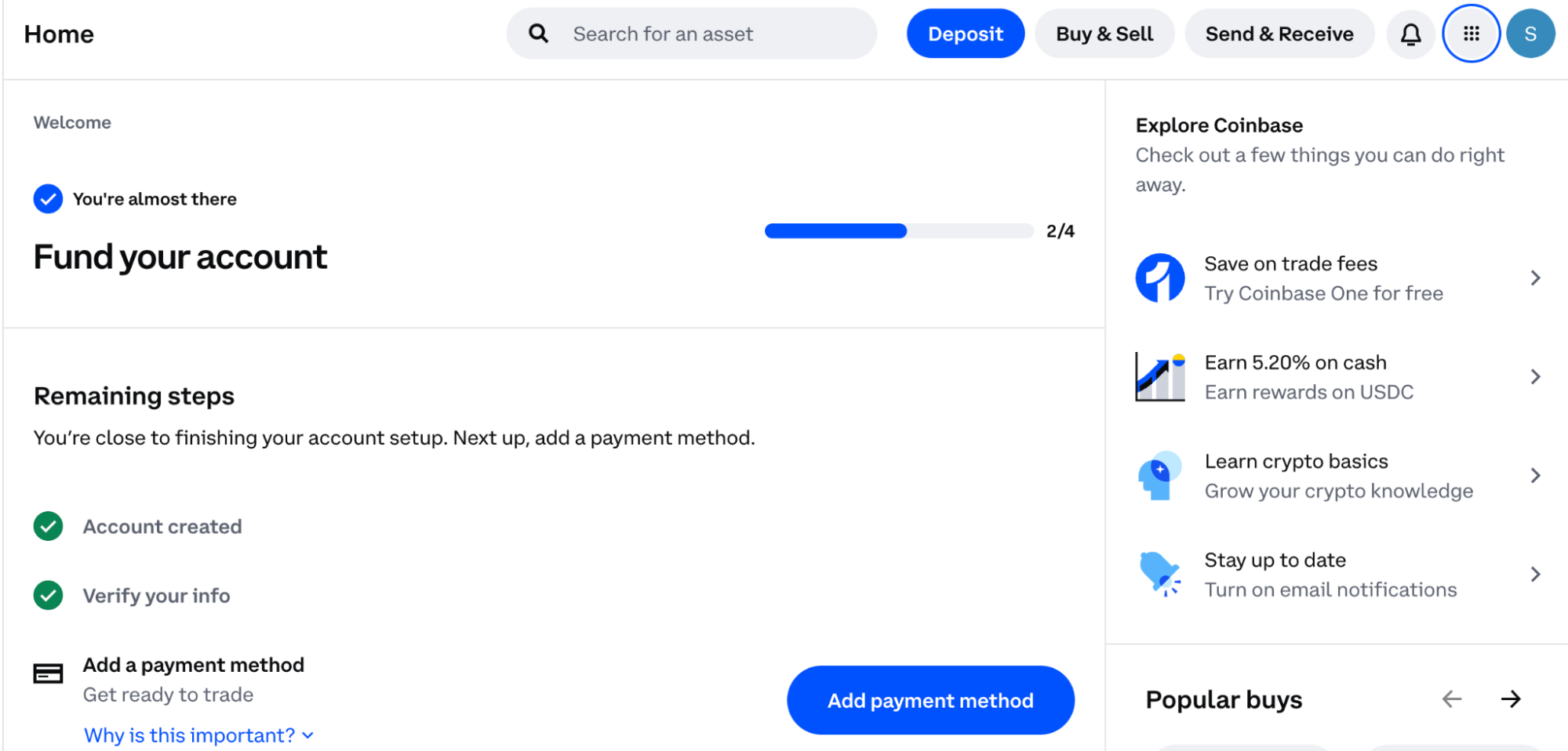

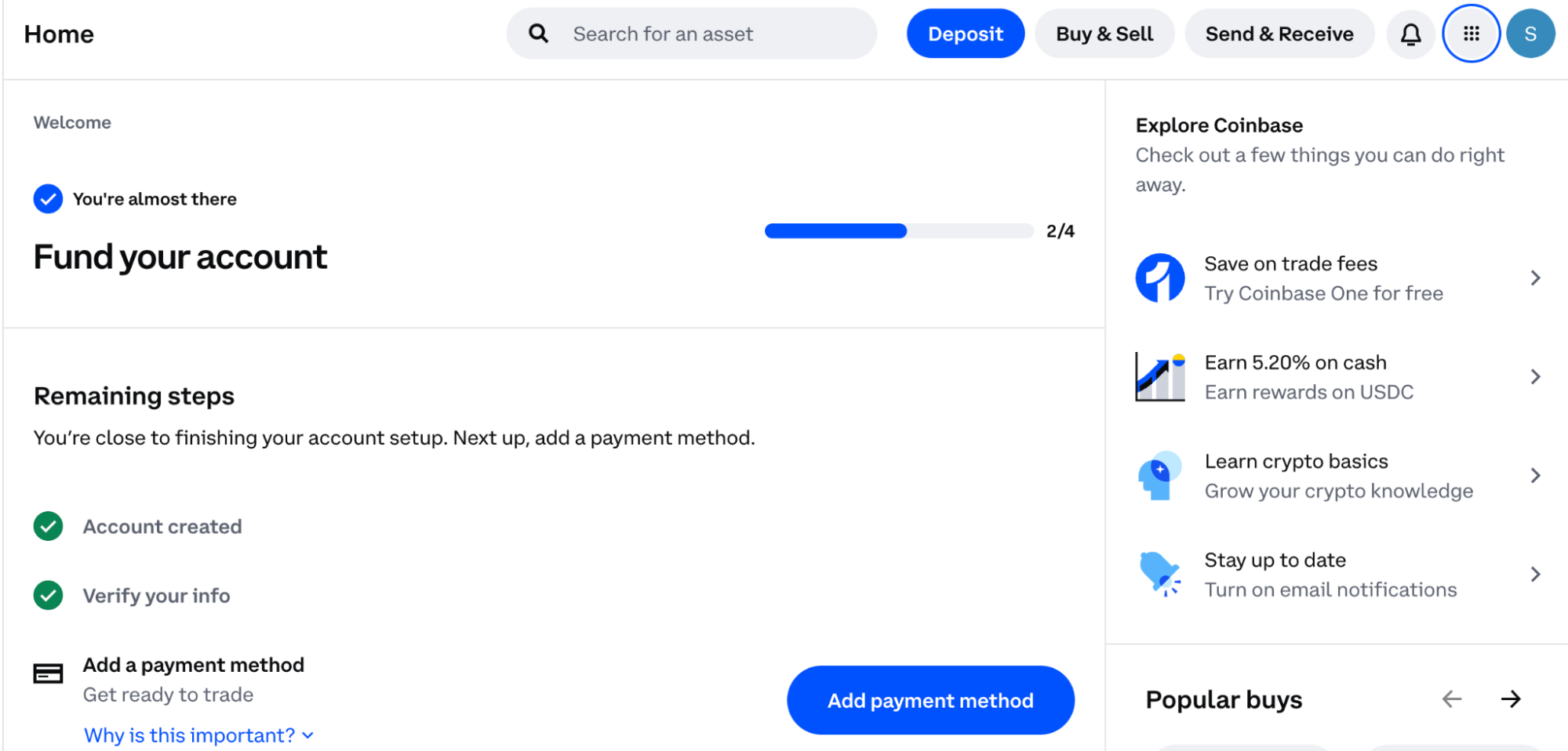

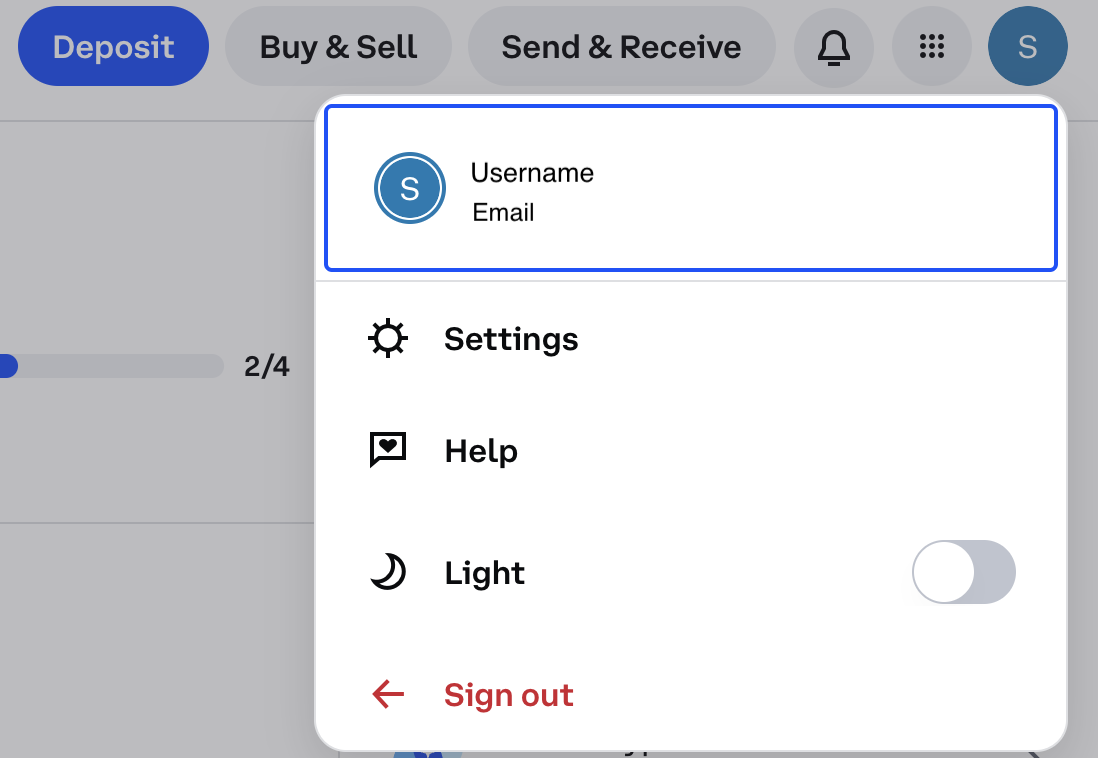

Log In: Access your Coinbase account and go to settings by clicking on your profile icon in the top right corner.

Shortcut: To quickly access the settings page where you can generate an API key on Coinbase, follow this link and skip to step 3.

-

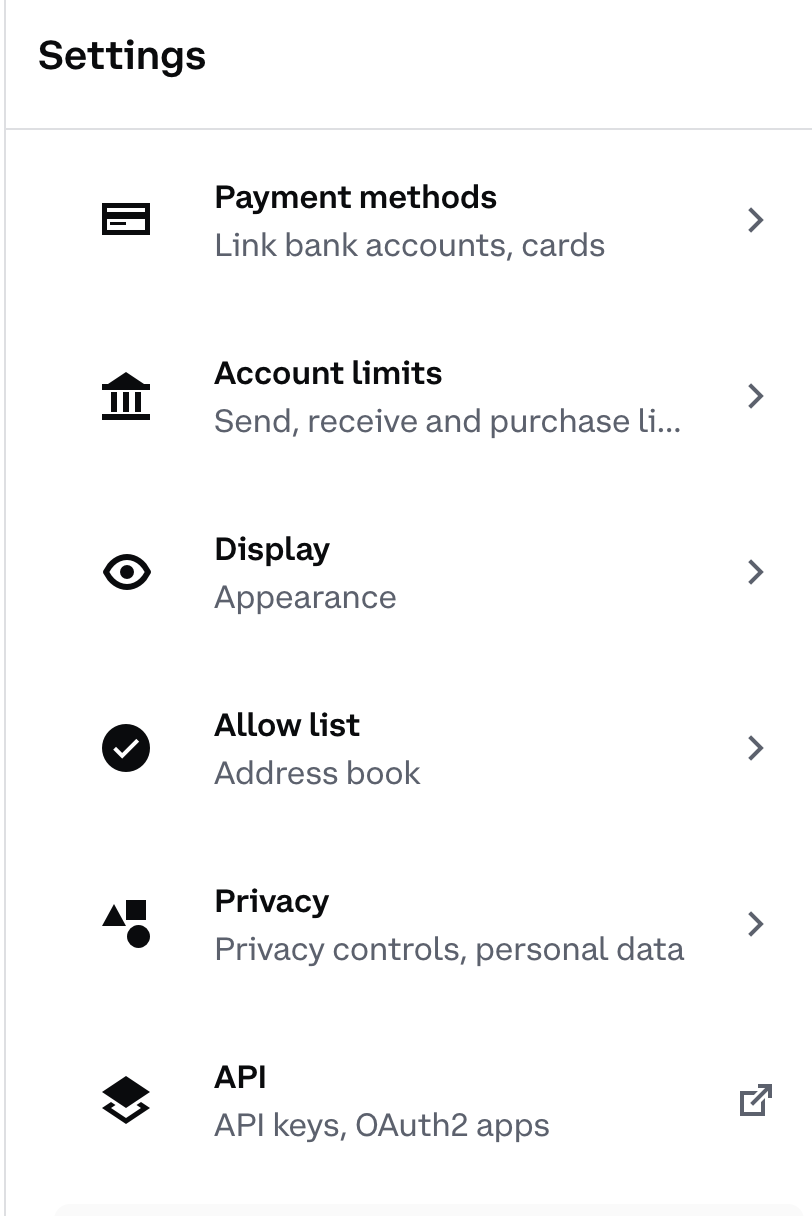

Navigate to API Settings: In the settings menu, find and select the ‘API’ section.

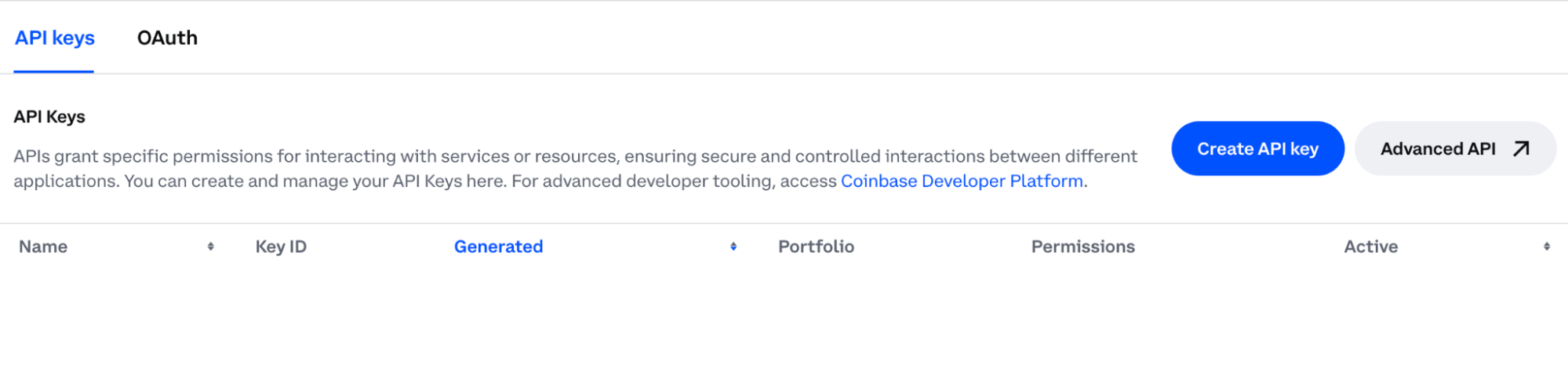

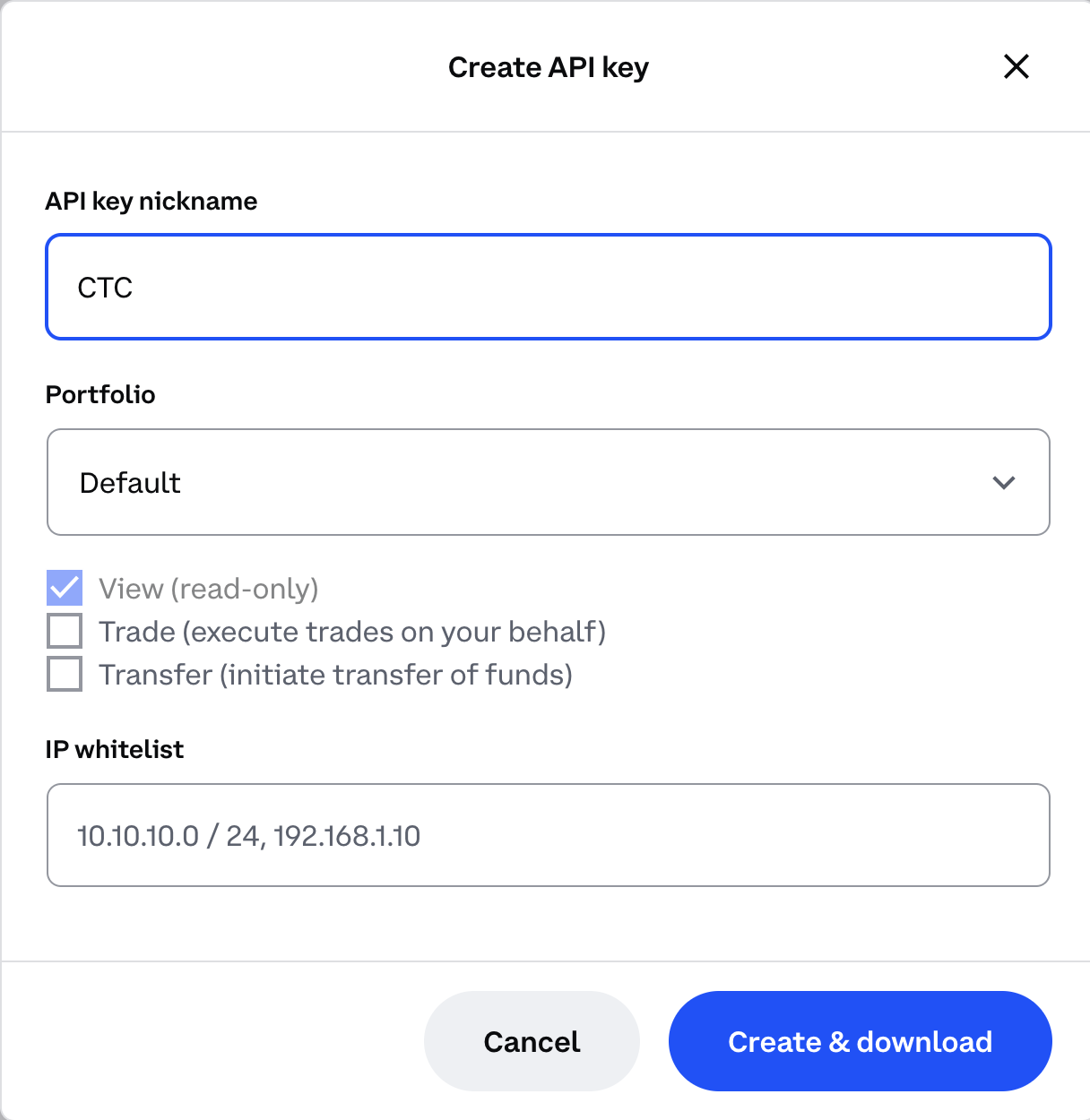

- Create a New API Key: Click on ‘Create New API Key’.

- Set Permissions: Choose the ‘Read-only’ permissions to ensure that the calculator can access your transaction data without modifying it.

- Generate API Key: Follow the prompts to generate your API key. You may be asked to enter your passphrase for security.

- Save Your Keys: Copy the API Key and Secret Key provided and store them in a secure location. You’ll need these for the import process.

On Crypto Tax Calculator:

-

Log In: Access your account on the Crypto Tax Calculator platform.

Note: If you don’t yet have a Crypto Tax Calculator Account, you can set one up for free using your Coinbase account credentials.

Shortcut: To quickly access the integrations page where you can add Coinbase to your CTC account, follow this link and skip to step 5.

-

Go to Integrations tab: Navigate to ‘Integrations’ from the tabs at the top of the page.

-

Add Integration: Click the ‘add integrations’ button.

-

Select Coinbase: choose Coinbase as your exchange from the available options.

-

Paste API Keys: Enter the API Key and Secret Key you obtained from Coinbase and click ‘Import’.

-

Wait for Data Upload: The import process may take a few minutes. During this time, you can proceed with importing data from other exchanges or tasks.

Uploading Your Coinbase Transactions with a CSV File

If you prefer or need to use a CSV file, follow these steps:

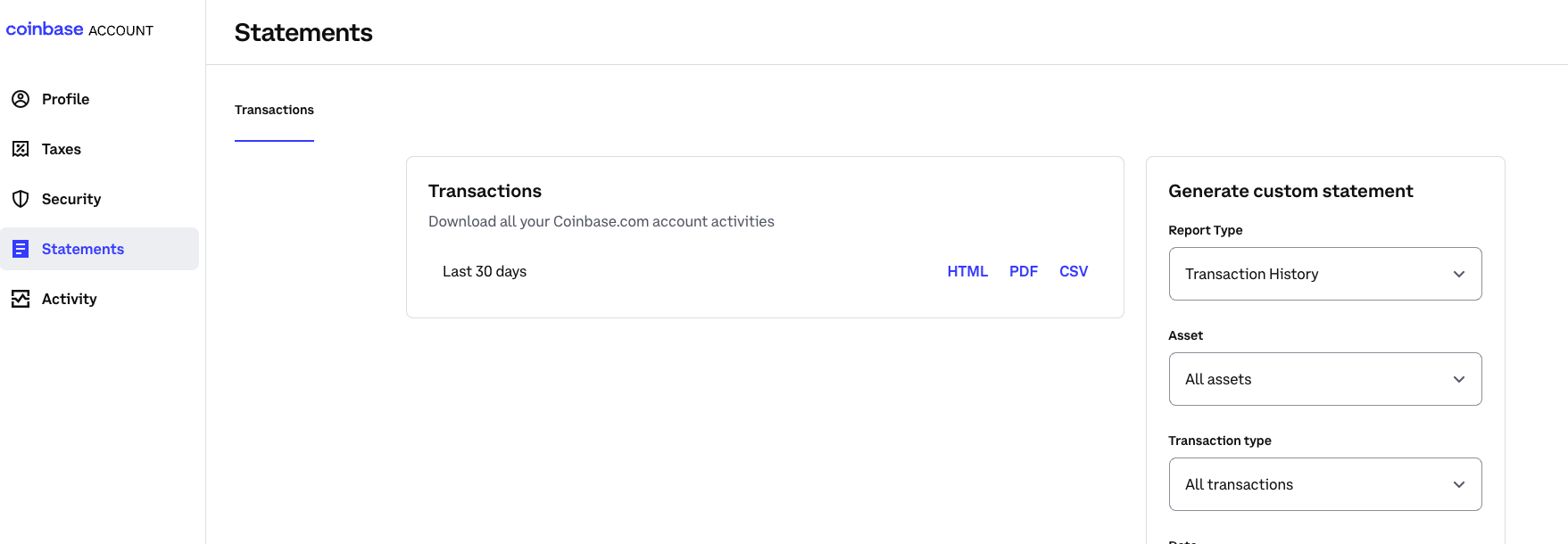

On Coinbase:

-

Log In: Access your Coinbase account.

Shortcut: To quickly access the settings page where you can generate a CSV report on Coinbase, follow this link and skip to step 4.

-

Navigate to settings: Go to the settings by clicking on your profile icon in the top right corner

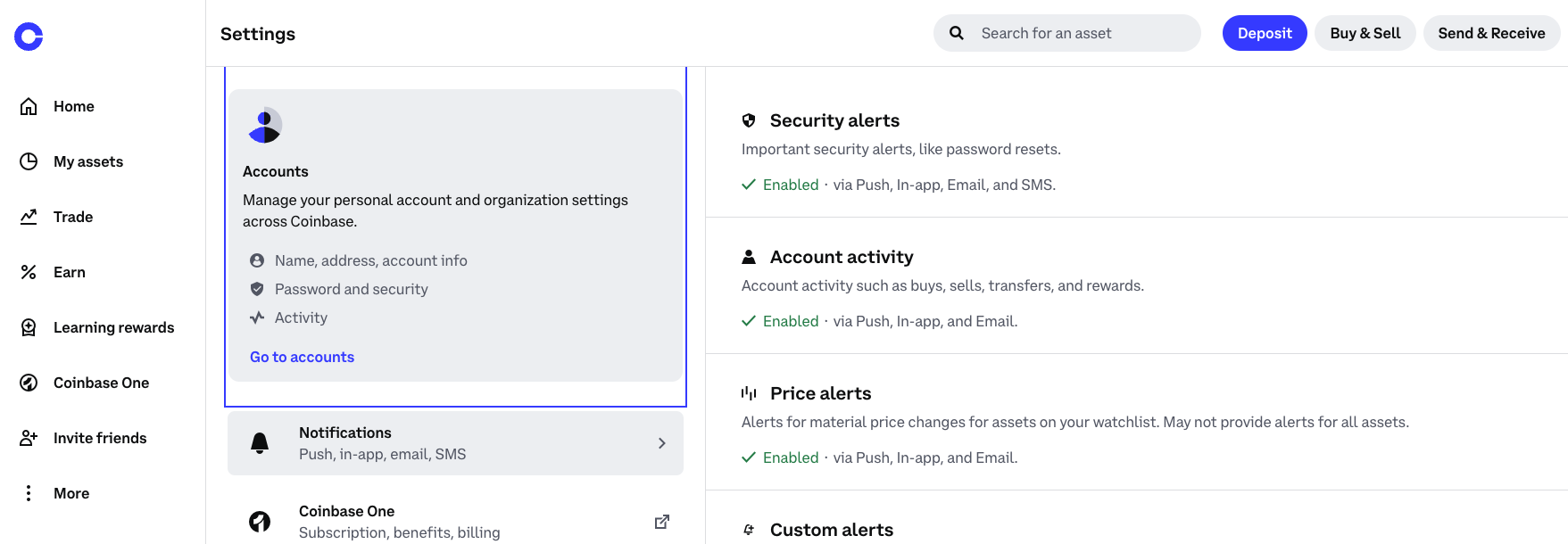

- Go to accounts: Navigate to accounts overview by selecting ‘Go to accounts’.

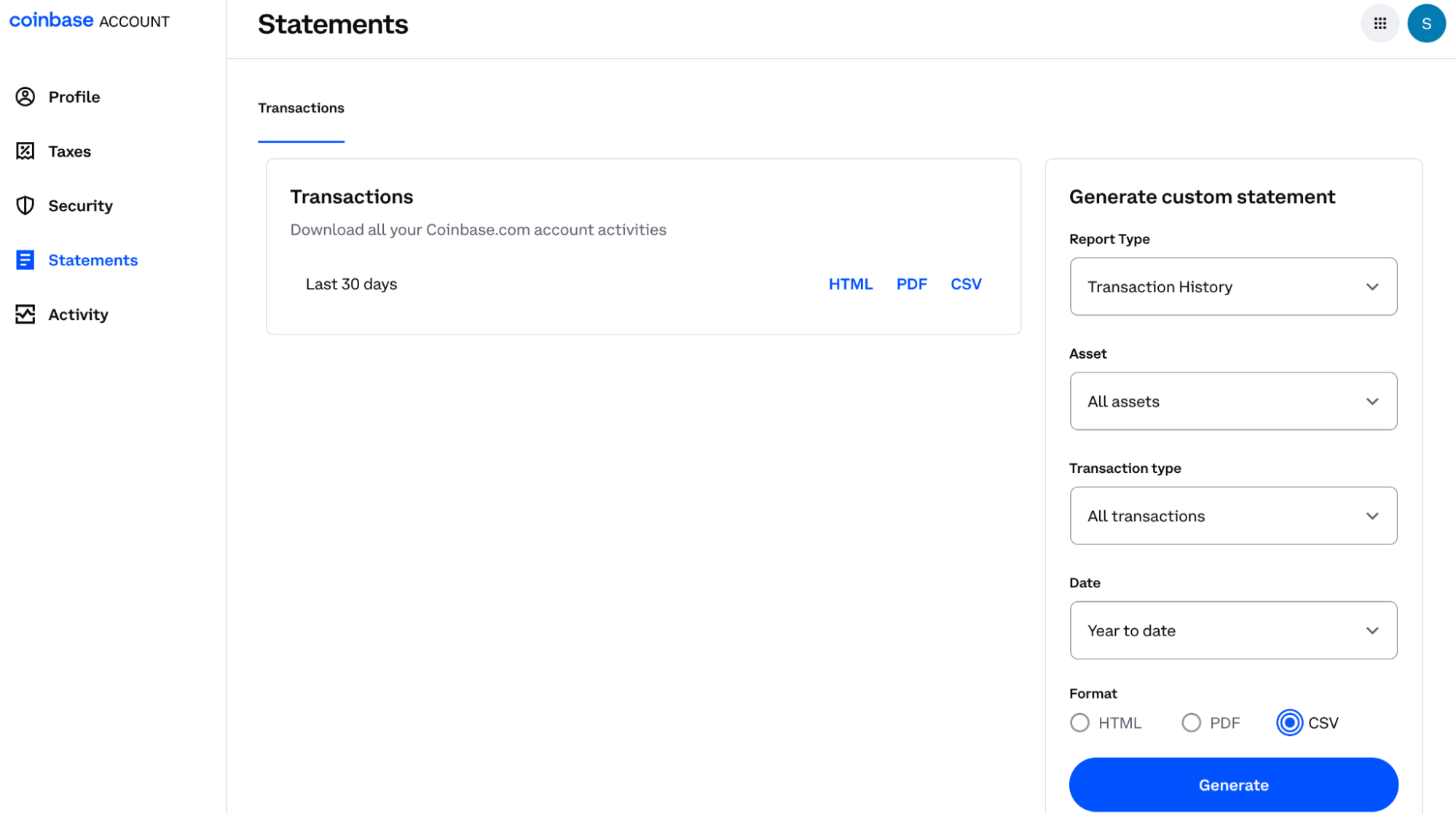

- Navigate to statements: Select Statements from the right hand menu.

- Create a report: by selecting the CSV file format. Download this file to your computer.

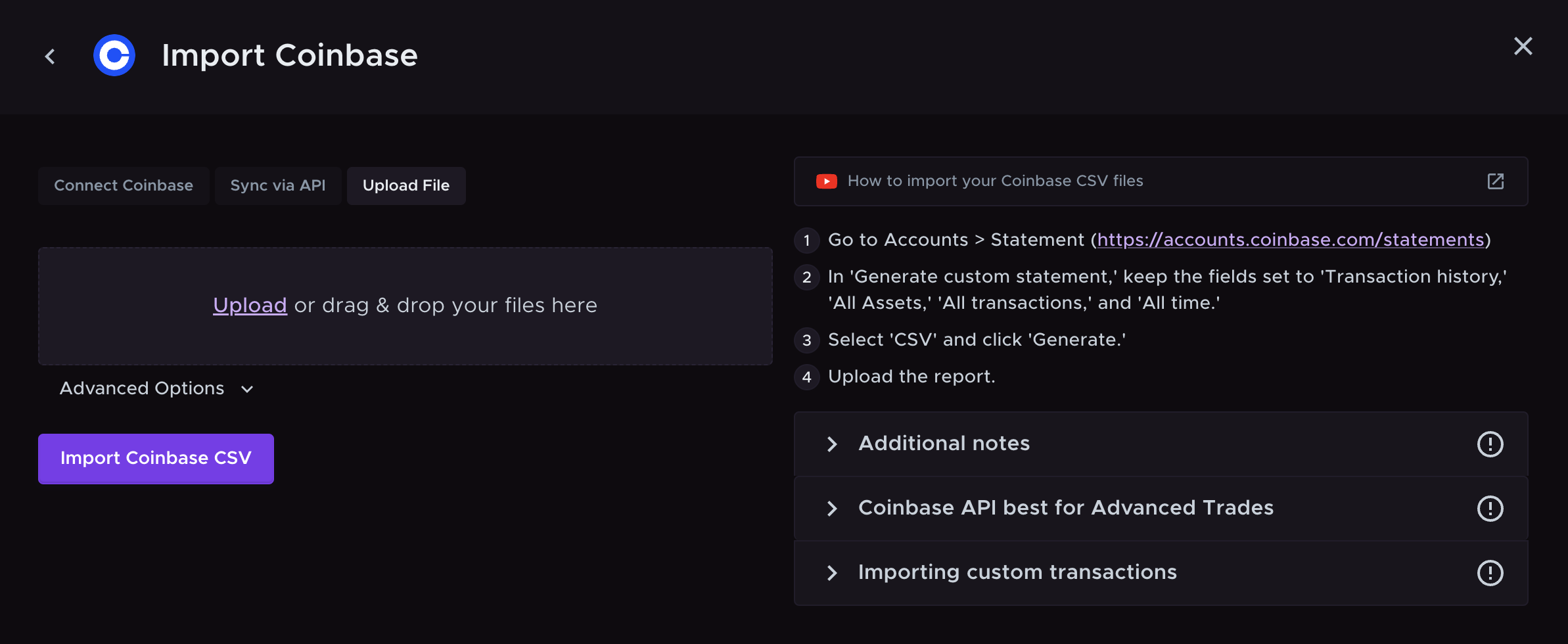

On Crypto Tax Calculator:

-

Log In: Access your account on the Crypto Tax Calculator platform.

Note: If you don’t yet have a Crypto Tax Calculator Account, you can set one up for free using your Coinbase account credentials.

Shortcut: To quickly access the integrations page where you can add Coinbase to your CTC account, follow this link and skip to step 5.

- Go to Integrations tab: Navigate to ‘Integrations’ from the tabs at the top of the page.

-

Add Integration: Click the ‘add integrations’ button.

-

Select Coinbase: choose Coinbase as your exchange from the available options.

-

Upload CSV File: Click on ‘Upload File’ and select the file you downloaded from Coinbase.

- Verify Data: Ensure that all transactions have been imported correctly and make any necessary adjustments.

How to get Coinbase tax documents

If you earn at least $600 from your trading on Coinbase you’ll receive a 1099-MISC from Coinbase, and if you traded futures, you’ll receive a 1099-B. You can easily download these forms in your Coinbase account.

Here’s how:

- Log into your Coinbase account.

- Go to Coinbase Taxes.

- Select “Documents.”

- Download your tax documents.

You can also use Coinbase Taxes to download gain-loss summaries and raw transaction history using the custom reports feature.

Are Coinbase transactions taxable?

Most Coinbase transactions are taxable, including selling crypto, crypto-to-crypto swaps, staking rewards, and more. The amount you’ll pay in taxes depends on a few factors, including the type of transaction, the value of the transaction, and your taxable income for the year.

If you aren’t sure if your Coinbase transactions are taxable, you can export your transactions to crypto tax software like Crypto Tax Calculator or consult a tax professional with experience with cryptocurrency transactions.

Sources

Crypto Tax Guide

Unsure about your crypto tax obligations? This comprehensive guide helps you understand and file your crypto taxes.

Learn about crypto taxes

DeFi Tax Guide

Have you been dabbling with DeFi? This in-depth guide breaks down the details of DeFi taxes so you can file with confidence.

Learn about DeFi taxes

NFT Tax Guide

Tried your hand at NFT trading? This complete guide that breaks down the details of NFT taxes so you can file with confidence.

Learn about NFT taxes