How to do your MetaMask taxes in 2025

Key takeaways

- Tax agencies can track your Metamask transactions, so it’s important to file your crypto taxes properly.

- MetaMask doesn’t currently provide ready-to-file tax forms, but there is a manual process you can follow to get your relevant data.

- You can use crypto tax software, such as Crypto Tax Calculator, which easily integrates with MetaMask to give you an overview of your taxes within minutes.

When it comes to filing MetaMask taxes, it’s important to understand what’s involved to stay compliant. Using MetaMask to sell, swap, or stake crypto is typically treated as a taxable event in most countries, and as a user of the platform, you’ll most likely need to calculate and report taxes for your transactions.

MetaMask does not collect or report taxes on your behalf, making it your responsibility to manage and file your crypto income. While MetaMask tax reporting may seem complicated, with the right tools and guidance it doesn’t have to be.

In this guide, we’ll walk you through:

-

How to calculate taxes for MetaMask

-

How to use crypto tax software for reporting accurate MetaMask taxes

-

How to get MetaMask tax documents

-

Which MetaMask transactions are taxable

-

If MetaMask reports to the IRS

How to calculate taxes for MetaMask

If your MetaMask activity has been limited to basic buying, selling, and staking, you may be able to calculate your transactions manually. You can do this by exporting your transaction data using a block explorer like Etherscan (see our section below on how to get MetaMask tax documents for a detailed walkthrough).

However, since MetaMask is often used for DeFi and more complex transactions, calculating taxes manually can be challenging. To simplify the process, you can use crypto tax software like Crypto Tax Calculator . All you need to do is connect your MetaMask account and CTC will automatically import your transactions and handle the tax calculations in accordance with your country’s regulations.

How to do your MetaMask tax with Crypto Tax Calculator

Reporting your MetaMask taxes using Crypto Tax Calculator is straightforward. You don’t need to manually export data or calculate anything.

Instead, simply link your public wallet address and Crypto Tax Calculator will analyse the data to identify things like swaps, staking, liquidity pools and other DeFi activities. It will then produce a tax report, ready for your accountant or local tax authority.

Here’s how to get started:

Connect all of your exchanges, wallets, and platforms to import your transaction history. Make sure to link all of your accounts besides just MetaMask to ensure you receive an accurate tax report.

While Crypto Tax Calculator does the hard work for you, it may flag some missing data or errors which you you will need to review to ensure accuracy.

Generate a comprehensive tax report ready for your accountant or local tax authority.

If you're new to Crypto Tax Calculator, start with our Getting Started Guide for an overview of how the platform works.

How to use the Tax Hub in MetaMask Portfolio

Crypto Tax Calculator has partnered with MetaMask to provide an embedded tax calculator in MetaMask Portfolio. You can use this tax calculator to download tax reports and learn more about your tax obligations.

Step 1. Log in to the Tax Hub in MetaMask Portfolio

- Open MetaMask Portfolio. From the left-hand menu, select "Tax Hub".

- Sign in to the Tax Hub via one of the following methods:

- Sign in using your MetaMask wallet.

- Sign in with your existing account details if you already have a Crypto Tax Calculator account.

- Create a new account with Crypto Tax Calculator using your email address.

For the purposes of this guide, we will log in using MetaMask.

- Review the pop-up window asking permission to connect MetaMask with Crypto Tax Calculator. Click "Connect".

- Then, sign the confirmation request in your MetaMask wallet by clicking "Confirm".

- The following screen gives you an overview of the partnership between MetaMask and Crypto Tax Calculator, as well as the special offer for MetaMask users. Click "Continue" to accept and begin doing your crypto taxes.

You are now signed in to Crypto Tax Calculator and can proceed with importing your tax information.

Step 2. Import your tax information to Crypto Tax Calculator

You are now ready to add your information and get a free preview of your crypto taxes.

- Select your tax jurisdiction. Search for your country in the search bar, or click the "more" button to scroll through the full list.

- Once you select your jurisdiction, a confirmation will open at the bottom of the screen. Click "Confirm" to proceed.

- On the next screen, you'll see the public address from the MetaMask account you initially connected. Click "Import transactions" to import the transactions from this account. You will be able to add more accounts later.

- Wait for your transaction data to be calculated, then click "Get the report".

- If you have additional accounts you want to connect, you can add these here by clicking "Add accounts". Crypto Tax Calculator also suggests any accounts you may want to connect, such as deposit addresses from exchanges you have interacted with.

Add all of your wallets and accounts

To receive an accurate tax report, you must add all your wallets and accounts. This ensures an accurate cost basis for your assets and that the correct tax rules are applied to your transactions. Missing accounts or transaction data can lead to errors in reporting.

Read this guide to learn more about how to ensure data completeness. It includes steps you can take if data is missing due to an exchange insolvency.

Step 3. Review your summary and complete any outstanding tasks

You are now ready to review your data and get a tax report. For detailed instructions on how to use Crypto Tax Calculator, read this guide.

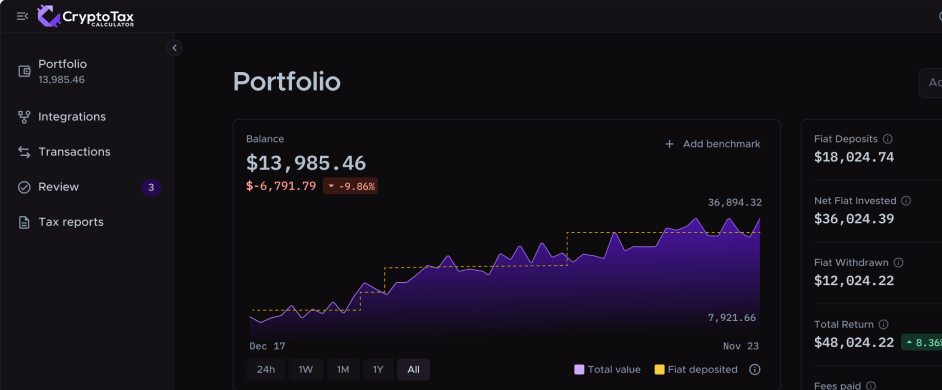

- First, review your data in the "Summary" tab. This will give you an overview of your portfolio.

- Then, review the "Accuracy checks" window at the top right of the summary screen for any additional steps you need to take. This is necessary to ensure that you receive an accurate report.

- Once these actions are completed, click on "Get tax reports" to see your tax report.

Step 4. Choose a plan to view your report

Creating an account using the MetaMask Tax Hub gives you access to a free version of Crypto Tax Calculator, which is designed to give you an estimate of your tax obligations.

To receive a complete and accurate tax report that is ready to submit to your local tax office, you will need to select a paid plan.

Select a plan depending on the number of transactions you require and the features you need. All plans provide unlimited integrations and annual tax reports for 100+ countries, including previous tax years.

Investor and Trader plans include features that identify several tax savings measures, including a proprietary tax minimization algorithm, multiple inventory methods, a tax loss harvesting tool, and advanced tax reports.

Step 5. Download your report

You can now return to the reports section of the website and download your report for your desired tax years.

To ensure accuracy, you should complete any outstanding review tasks before you download a report.

- Set your desired tax year or date range in the top left corner.

- Select the reports you wish to download. These will differ depending on what country you selected as your tax jurisdiction.

- Click "Download selected" to download your reports. You can choose to receive them as PDF or CSV files.

Your reports are now ready to use to complete your tax return.

The best crypto tax software for MetaMask – Crypto Tax Calculator

Crypto Tax Calculator is the best tax software for MetaMask because it is the official tax partner of MetaMask and powers the Tax Hub inside of MetaMask Portfolio.

In case you missed the news, in 2025 we officially partnered with MetaMask to make crypto tax easy for MetaMask's 30 million monthly active users. Simply access the Tax Hub inside of MetaMask Portfolio to do your MetaMask taxes with your Crypto Tax Calculator in just a few clicks.

Crypto Tax Calculator is designed with DeFi users in mind, and can handle even the most complicated of portfolios and transaction types. Simply link your wallet address and it will automatically scan, categorize and calculate the tax owed on your transactions.

You can add as many accounts as you like from other on-chain wallets and centralised exchanges, streamlining the tax process and saving you a headache.

CTC generates tax reports that comply with the requirements of numerous tax authorities, including the IRS, HMRC, ATO, CRA, and many more.

But don’t just take our word for it. Crypto Tax Calculator has a 4.8-star rating on Trustpilot, with countless positive reviews. Here’s one from Mike Drav:

“I've tried Koinly, TaxBit, CoinLedger… and my conclusion is that CryptoTaxCalculator is the best crypto accounting/tax software on the market and it's not even close.”

Built for MetaMask users like you.

No credit card required

How to get MetaMask tax documents

MetaMask doesn’t currently provide complete tax reports ready for you to file. You’ll need to either export your transaction data in a CSV file–which MetaMask doesn’t currently have the option for–or extract your on-chain trade information with a blockchain explorer, which can be a complicated process. Here’s how you can export your transaction data using Etherscan:

-

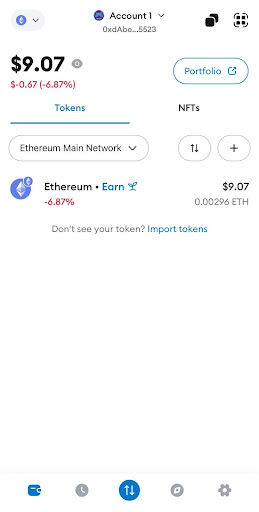

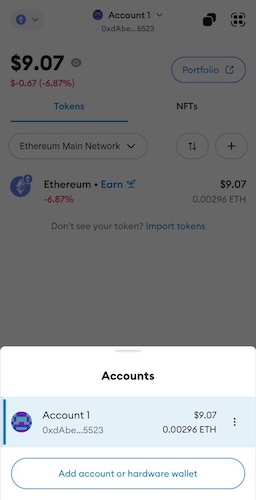

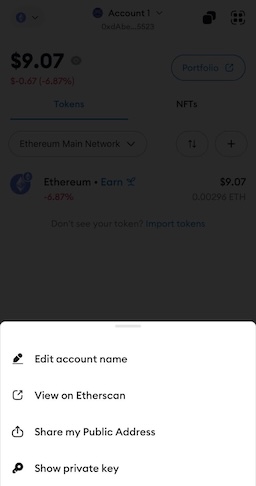

Open your MetaMask wallet.

-

Click on your account name (in this case “Account 1”).

- This will open up a window at the bottom of your screen.

- Click on the three dots at the bottom right, then select “View on Etherscan.”

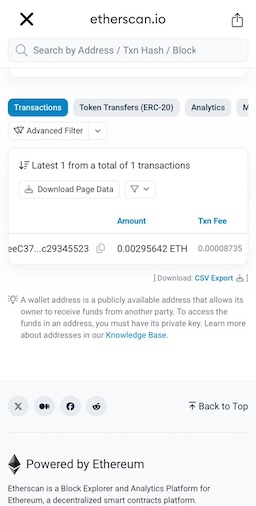

- Underneath your transactions, you’ll see an option to download a CSV export.

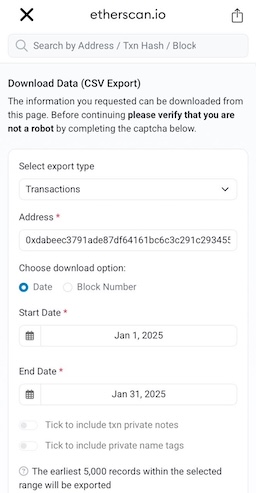

- Click on “CSV Export” and it will open a window where you’ll be asked to specify a date range for your transactions.

- Once you complete the verification widget, you’ll be able to download the CSV file showing all of your MetaMask transactions for the specified time frame.

Keep in mind: these steps will only help you create a record of your MetaMask transaction history, and may not provide all the details you need to file an accurate tax return.

Alternatively, you can use crypto tax software like Crypto Tax Calculator, which is an official partner that integrates seamlessly with MetaMask so you can easily import your transactions and have an overview of your taxes almost immediately.

Are MetaMask transactions taxable?

Yes, MetaMask transactions are taxable. If they result in capital gains or income, chances are you’ll need to report and pay tax on them. The specific tax amount depends on where you live and the type of transactions you have made. If you used MetaMask for the following decentralized finance (DeFi) activities, then they are taxable events:

-

Swaps (buying and selling)

-

Providing liquidity and yield farming

-

Lending

-

Earning interest

Read more about how cryptocurrency is taxed in your local country here.

Does MetaMask report to the IRS?

No, MetaMask does not currently report to the IRS.

But just because MetaMask doesn’t report transactions to the IRS, it doesn’t mean the IRS can’t track your activity. Transactions on blockchains such as Ethereum are available for the public to view, which the IRS can trace back to your wallet. So, it’s important to make sure you report all taxable events to prevent any unwanted issues with tax authorities.

It’s also important to know that the crypto tax reporting landscape is evolving in the US. In 2025, centralized crypto exchanges (CEXs) will be required to report users’ digital currency trades–including crypto–to the IRS. Starting in 2026, certain digital brokers will send taxpayers a 1099-DA form for digital asset proceeds from broker transactions and file it with the IRS.

For years, DeFi protocols have been operating in a complex regulatory environment, but that’s changing with the new DeFi broker tax regulations. The IRS regulations state that front-end trading services–including websites, non-custodial wallets, and browser extensions that allow users to exchange digital assets–will be classified as “brokers” moving forward.

As a result, starting January 2027, DeFi trading platforms will be required to track and report customer transactions and file a 1099-DA form with the IRS.

Sources

Crypto Tax Guide

Unsure about your crypto tax obligations? This comprehensive guide helps you understand and file your crypto taxes.

Learn about crypto taxes

DeFi Tax Guide

Have you been dabbling with DeFi? This in-depth guide breaks down the details of DeFi taxes so you can file with confidence.

Learn about DeFi taxes

NFT Tax Guide

Tried your hand at NFT trading? This complete guide that breaks down the details of NFT taxes so you can file with confidence.

Learn about NFT taxes